The Power of Business Metrics

From July 2008 to October 2019, my portfolio averaged 18% annual returns—a result that would have been impossible by focusing on stock prices alone. Early in my investing journey, I made buy-and-sell decisions based on price movements but later realized that revenue, profit, and business fundamentals drive true success.

Lessons from Warren Buffett and Charlie Munger

Warren Buffett highlights great investors like Charlie Munger, who lost 30-31% per year for two consecutive years yet remained one of the best investors. Buffett himself has seen his portfolio drop 40% multiple times, yet neither panicked because they focused on business fundamentals, not stock price volatility.

Most investors react emotionally to market fluctuations. Imagine your portfolio dropping 30% for two years—a 51% total decline. Without a business-first mindset, such losses cause most investors to sell at the worst time.

Stock Price Volatility vs. Business Stability

Starbucks and Apple

During the 2008 crisis, Starbucks’ profits remained stable, yet its stock price fell 70-80%. Similarly, Apple’s profits grew every quarter from 2007-2009, yet its stock price still dropped 50%.

Buffett focuses on profit stability, while most investors focus on price declines, triggering panic selling. Apple’s 2009 drop lasted just 12 months, but for many, it felt permanent. If you can’t handle such declines, you shouldn’t invest in stocks.

The Netflix Example: Long-Term Vision Over Short-Term Panic

In 1995, I predicted the rise of online movie rentals and the decline of Blockbuster, essentially forecasting Netflix’s success. However, I wasn’t investing then and missed one of history’s greatest stock runs.

Since going public in 2002, Netflix’s stock has surged 26,000%—a $10,000 investment would now be worth $2.6 million. Yet, in 2011, it dropped 81%. Investors who focused on stock price volatility likely sold, while those who understood Netflix’s business model stayed in and profited.

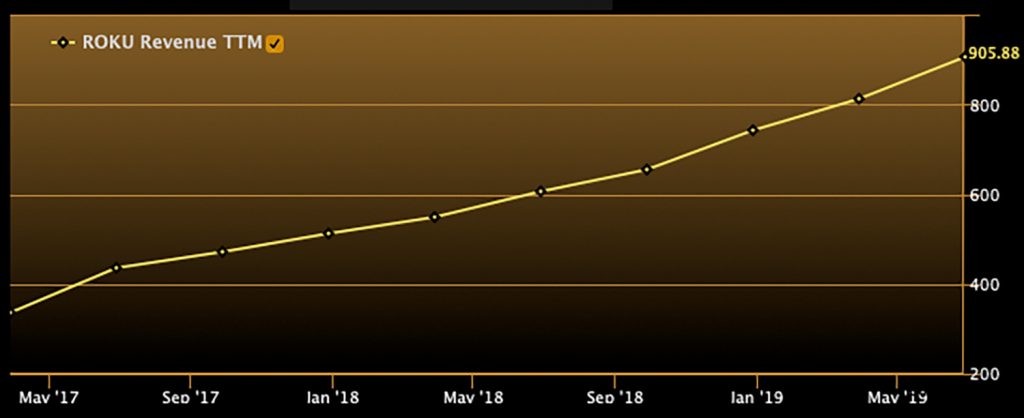

Roku: Volatility vs. Fundamentals

Roku’s stock is a classic roller coaster:

- 2018: +152% in 6 months

- Then: -64% in 3 months

- 2019: +430% from $27 to $170

- Then: -41% in 3 weeks

Many investors panic at such swings, but Roku’s revenue growth remained steady. Those who focused on business metrics rather than stock prices avoided emotional decisions and reaped the rewards.

Stock Traders vs. Business Owners

- Stock traders focus on daily price movements and often sell at losses.

- Business owners understand company fundamentals and hold through volatility.

Buffett never invests in businesses he doesn’t understand, emphasizing that he wouldn’t care if the stock market was closed for 10 years. His focus is on the business itself, not short-term price fluctuations.

Final Thoughts: Invest Like a Business Owner

To build real wealth, stop tracking daily stock prices and start analyzing business fundamentals. Stocks will always experience bear markets and recessions, but businesses with strong revenue and profit growth will recover and thrive.

By thinking like a business owner, you’ll avoid costly mistakes, sleep better at night, and maximize long-term returns