How I Outperformed Hedge Funds and Warren Buffett

My Investing Journey

Curt Wu

In 2008, after losing money relying on others’ advice, I took control of my investments. By extensively researching stocks during the 2008-2009 financial crisis, I positioned myself to outperform most hedge funds and even Warren Buffett.

Recognizing the Market Crash

By early 2008, economic indicators signaled trouble: the housing bubble, rising interest rates, an inverted yield curve, and weak leading indicators. Anticipating a bear market, I moved almost entirely to cash by March 2008, which protected my portfolio when the market crashed.

Capitalizing on an Opportunity

By late 2008 and early 2009, stocks had become historically cheap. I saw a rare buying opportunity, but few shared my urgency. I analyzed undervalued small-cap stocks, narrowing down a list of 100-200 companies to 30 based on chart patterns and fundamentals.

Market Timing and Execution

Despite delays waiting for a finance professional to vet my picks, I finally bought in April 2009:

April 15: Boise, CrossTex Energy

April 16: Macquarie Infrastructure

April 17: Harry Winston Diamond, Las Vegas Sands, Sonic Automotive, OceanFreight, Trico Marine, Mesa Airlines

Within weeks, my portfolio surged. Had I entered a month earlier, my returns would have been even greater.

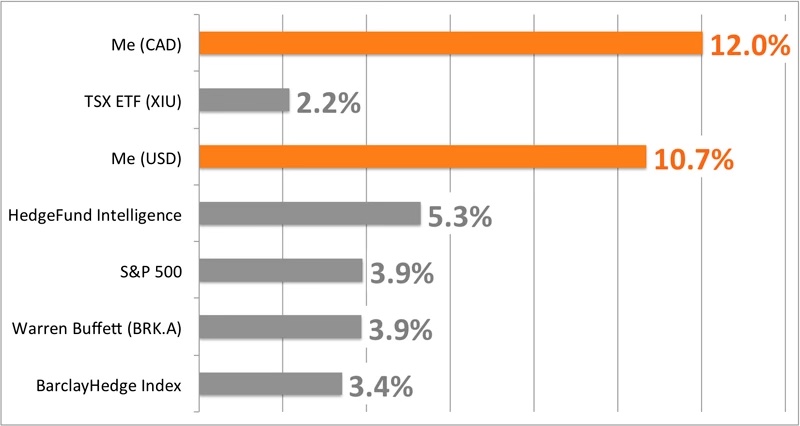

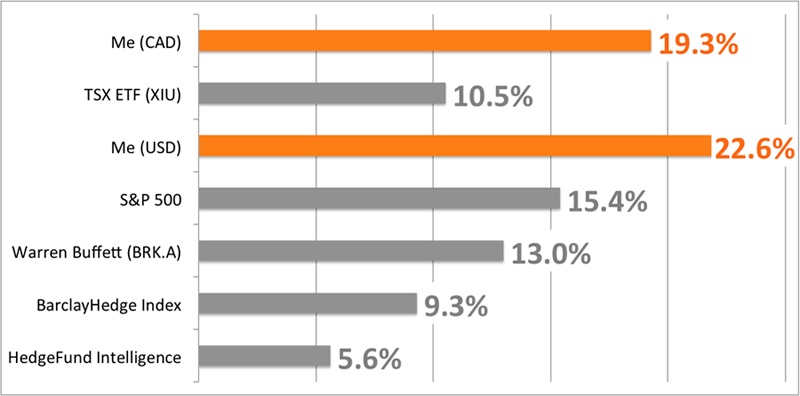

Overall, here are my average annual returns:

2008–2013

2009–2013

Lessons from Success and Mistakes

Although my investments performed exceptionally well, inexperience led to premature selling and missed gains. Had I held my April 2009 stocks, my portfolio would have grown 1,200% in five years—or 2,400% if I bought a month earlier. Despite this, I still doubled my portfolio in 2009.

Risk and Market Psychology

Contrary to popular belief, buying undervalued stocks in a downturn is less risky than buying at market highs. Many investors mistakenly perceive expensive stocks as “safe” and cheap stocks as “risky,” leading them to poor decisions.

Later Years and Insights

In 2011, I exited stocks amid volatility, missing later gains. By 2013, my returns aligned with market performance. My investing experience led me to work as an Investment Advisor, deepening my understanding of the industry.

Final Thoughts

I continue to learn and refine my strategies, and I share these insights through my blog to help others navigate the market with confidence.